Aarp Supplemental Insurance | Aarp Supplemental Health Insurance (2023)

Aarp Supplemental Insurance provides various supplementary coverage, including accidents, disability and health insurance. In addition, AARP members help to get a discount on car insurance and homeowner insurance.

Also Read : Walmart Cat Insurance | Walmart Pet Care | Walmart Pet

AARP Medicare Supplemental Insurance Scheme with Medicarex Prescription Drug Plan

AARP Supplemental Insurance offers a scheme of medical-cutting retirement that the opportunity to choose from a variety of certified plans (eg A-N scheme) helps to pay for some and all retired expenses that are not paid by part.

These Medicare Supplemental Insurance Schemes are known as the “MedigAd” scheme. Each plans offer the benefits of different levels.

And the monthly premiums are changing accordingly, Since there are many plans or variables, you need to contact the United Healthcare for details.

AARP membership | Aarp Supplemental Insurance

AARP Medicare Supplementary Supplementary Schemes may require membership in AARP. If you are not an ARP’s child member, but if you are late to enter the AARP Medicare supplementary plan, the United Helthath pays for your member’s first year.

Also Read : Bharti AXA Life Insurance Customer Care | Bharti AXA Life Insurance

(Not available to the residents of New York); Otherwise, you can pay direct bills directly to the annual membership for AARP, $ 16.00 in each household.

aarp supplemental health insurance | Aarp Supplemental Insurance

Our advisements Why we recommend AARP Medicare Supplement

Medicare Supplement Insurance( also called Medigap) plans from AARP/ UnitedHealthcare are a good choice for utmost people. The client service standing isn’t as strong as that of some other companies.

still, the wide range of policy selections makes it easy to choose the stylish plan for you, and the AARP countersign can give you peace of mind.

They are some of the stylish Medicare Aarp Supplemental Insurance plans available, and they are also the most popular plans, with about 32 of Medicare Supplement subscribers having an AARP/ UnitedHealthcare plan.

Insurance policyholders must be AARP members, and you can join during your insurance operation if you are not formerly a member. Class costs are minimum at only$ 16 per time.

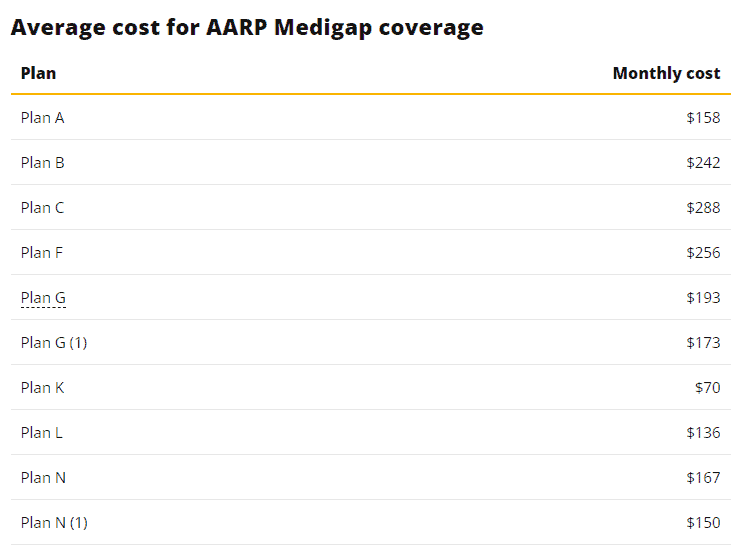

Costs for Aarp Supplemental Insurance vary extensively, ranging from about$ 60 to$ 300 per month. Getting a price quotation grounded on your situation can help you understand if an AARP policy is the stylish deal for you.

Also Read : Tin Leg Travel Insurance | Tin Leg Travel Insurance Reviews

Despite the big cost differences, Aarp Supplemental Insurance plans are typically a good value, but the slower age- grounded price increases could mean they’ll have the cheapest plan.

when they are in their 80s and 90s. This reduces the total continuance spending.

For those who want a reduction on insurance, AARP Medigap offers low- cost druthers that limit some content to in- network installations and providers.

These plans could save you$ 200 to$ 250 per time on your insurance costs, and with United Health care’s large network of providers, you may not see a meaningful impact on health care access.

Madigan costs vary by state | Aarp Supplemental Insurance

Costs for supplemental plans vary extensively. To a large degree, this is due to country differences in pricing rules.

Eight countries enjoin cost increases grounded on age or health condition. utmost other countries are allowed to increase yearly costs as you get aged.

Also Read : TVS Insurance | Tvs Insurance Portal | TVS Insurance Vehicle Information

And there are three states that do n’t follow the standard Medigap plan letters and have their own style of plans and pricing.

What are the medical supplement insurance plans?

The original Medicare offers the cost of covering health services. However, Medicare beneficiaries also have to pay copy, security and annual deduction. Private Aarp Supplemental Insurance companies are sold as Medigep to pay the gaps in this payment.

However, Medigap policies do not include all health care costs. In a nutshell, it does not include services such as long-term care, vision or dental care and private-entertaining nursing. They can not cover even auditory and glasses.

When a person lives and when they are eligible for Medicare, they can be chosen from 10 different medaging strategies.

3 Best Medicare Supplement Plans for 2023 | What is the most popular AARP Medicare Supplement plan?

AARP® Medicare Supplement Insurance Plans allow Medicare-eligible retirees to choose from a variety of standardized plans (eg, Plans A-N) for some and all of the retiree’s out-of-pocket expenses not covered by Medicare Part A and B Part.

What are the ten plans? | Aarp Supplemental Insurance

Medigap plans are given one recognizable letter to each of them: A, B, C, D, F, G, K, L, M and N. Each plan of the same letter should provide the same benefits in all states, with the exception. Massachusetts, Minusota or Wisconsin.

However, the cost can vary from the state to the state and different insurance companies.

Also Read : La Familia Auto Insurance | La Familia Auto Insurance: Auto Insurance

Medigap plans are given renewable guarantees, which means that if anyone pays their monthly premiums, the insured cannot stop their plan. This applies if anyone is ill after buying a plan.

Not all plans are available in some cities.

Some Medigap policies provide additional benefits like healthcare while traveling outside the United States.

Which MedPAP Plan AARP offers? | Aarp Supplemental Insurance

AARP member can select from 8 certified Medigap plans offered by the United Healthcare. These plans A, B, C, F, G, K, L or N.

Although all 50 states have at least one of these plans, but people have all the 8 schemes offered in their state. A person can use this online research to find a plan in their area.

In addition, if a person is eligible for a Medicare on or after a January 2020, it cannot buy Medigap Plan C or F, which is part -B’s.

What is the cost of MedigAp plans? | Aarp Supplemental Insurance

The premium of AARP MedPAPP scheme changes according to a person’s location or according to the method used by the company to set the company prices. Three systems include these:

The community is rated, where everyone with a policy gives the same premium regardless of their age Issue-e-rated, where premiums are in accordance with the age of a person when they get the first strategy.

but they do not grow due to age Income-age rated, where premiums are age-related or can grow because of an adult As an example, the estimated price of the 65 -year -old women, at Florida’s Penco Cola, shows the estimated price below.